what is the capital adequacy ratio?

Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital to its risk-weighted assets and current liabilities. It is decided by the central banks and bank regulators to take more advantage of commercial banks and protect them from insolvency in the process.

capital adequacy ratio UPSC

Because of the need for reforms in corporate governance, the report states that the banking system should try to raise private capital from the market for capital formation while being less dependent on government aid.

What is the current capital adequacy ratio in India?

Capital adequacy ratio base 3 Norms set a CAR of 8%. In India, the Reserve Bank of India (RBI) mandates CAR to be maintained at 9% for scheduled commercial banks and 12% for CARs for public sector banks. The Financial Stability Report (FSR) is a bi-annual publication of the Reserve Bank of India that presents an overall assessment of the stability of India’s financial system.

On a macro-economic scale, the situation is not very good, as private consumption has weakened and the current account deficit (CAD) has put pressure on the fiscal front. This also affects the government’s borrowing from the market and market interest rates. Reviving the demand for private investment is also an important challenge. In such a situation, it can be said that better coordination of monetary and fiscal policies at the international and domestic level can ensure systemic stability.

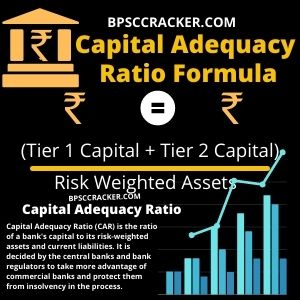

Capital adequacy ratio formula

What is the Capital Additive Ratio Formula?

The Capital Adequacy Ratio (CAR) or CRAR is calculated by dividing the bank’s capital with joint risk-weighted assets for debt risk, operating risk, and market risk. It is calculated by adding the bank’s Tier 1 capital and Tier 2 capitals and dividing by the total risk–weighted assets.

what is the capital adequacy ratio with example?

- Tier 1 Car = (Qualified Tier 1 Capital Fund) = (Market Risk RWA + Credit Risk RWA + Operational Risk RWA)

- Total CAR = (Qualified Total Capital Fund) = (Credit Risk RWA + Market Risk RWA + Operational Risk RWA)

The formula for capital adequacy ratio (Car ):

CAR = (Tier 1 Capital + Tier 2 Capital) / Risk Weighted Assets

capital adequacy ratio for banks

- Tier I capital adequacy ratio here is the main capital of a bank, consisting of shareholders’ equity and retained earnings;

- Tier II Capital consists of revaluation reserves, hybrid capital instruments and subordinated term loans.

- Tier III capital consists of Tier II capital and short-term subordinated debt.

How to calculate capital adequacy ratio

There are two types of calculating capital adequacy ratio.

- Tier 1 Capital: It can absorb losses without the bank required to stop the business. Also called core capital, it includes ordinary share capital, equity capital, audited revenue reserve and intangible assets. It is a permanently available capital and is readily available to absorb the losses incurred by the bank, without stopping its operations.

- Tier 2 Capital: It can absorb losses if the bank is winding up and therefore gives depositors less measure of protection. This includes unadjusted reserves, unadjusted retained earnings and general loss reserves. If the bank loses all its Tier 1 capital, the bank is closed and used to absorb losses, then these capital cushion losses.

CAR is a measure of a bank’s available capital expressed as a percentage of the bank’s risk-weighted credit exposure. The capital adequacy ratio is also known as the capital-to-risk weighted assets ratio (CRAR). It is used to protect depositors and promote the stability and efficiency of financial systems around the world.

Risk-weighted assets

Risk-weighted assets: These assets are used to recover the least amount of capital that banks must have to reduce insolvency risk. The need for capital for all types of bank assets depends on risk assessment.

There has been a vast improvement in the asset quality of banks which reduced their gross NPAs (Non-performing assets) by more than 20% in March 2019. Lending by public sector banks increased by 9.6%, while it was 21% for private banks. Overall credit growth improved marginally to 13.2% in March 2019 from 13.1% in September 2018. Credit growth of Scheduled Commercial Banks (SCBs) reached double digits with that of Public Sector Banks.

After the government recapitalization in public sector banks, the overall capital adequacy ratio of commercial banks increased from 13.7% in September 2018 to 14.3% in March 2019, and the capital adequacy ratio of state- bank run during the same period. -CAR) increased from 11.3% to 12.2%. But there has been a marginal decline in the CAR of private sector banks.

About CAR the report

The FSR reflects the risks to financial stability, as well as the overall assessment of the Financial Stability and Development Council (FSDC) sub-committee on the resilience of the financial system. The report also discusses issues related to the development and regulation of the financial sector.

In other words, it measures how much capital a bank has as a percentage of total debt risk. Bank regulators implement this ratio to ensure credit discipline to protect depositors and promote stability and efficiency in the financial system.

Why CAR in the discussion?

The Reserve Bank of India (RBI) has said in its half-yearly financial stability report that the gross non-performing assets (NPA) in the banking system has registered a decline for the second consecutive half, while the debt The pace of giving is increasing.

Tier 1 Car = (Qualified Tier 1 Capital Fund) = (Market Risk RWA + Credit Risk RWA + Operational Risk RWA)

Total CAR = (Qualified Total Capital Fund) = (Credit Risk RWA + Market Risk RWA + Operational Risk RWA)

The Reserve Bank of India (RBI) has said in its half-yearly financial stability report that the gross non-performing assets (NPA) in the banking system has registered a decline for the second consecutive half, while the debt The pace of giving is increasing.